16 May 2022

A Family that plans together stays together

Before I begin, I would like to start by asking you - Does your family decides your next holiday together? If your answer is Yes, do you include your children in that discussion?

Due to the pandemic, I'm sure many of us would be waiting to plan for our next holiday. However, let's go into the era of pre-covid for a moment.

On average, a 10-day vacation would need at least a month's planning to shortlist your favourite destination, best hotels, flight timings, sightseeing places, etc. Correct?

Spend more time on financial planning with family

Now let's look at another aspect which sadly may not be that important for everyone, but as a Financial Adviser, I'm always curious to know –

How much time do you spend with your family members to plan for your upcoming financial goals?

An hour a week or

An hour every month or

An hour once a year?

When I ask this question to my clients in the initial meetings, I get responses like, "I don't remember when was the last time I discussed my finances with my spouse or children".

As a finance professional, I have always believed that “ Nobody becomes wealthy by making money. Individuals only become wealthy by managing money ”. For making money, an individual has to be brilliant in his / her occupation. On the other hand, for managing money, separate skills are required which is sadly not included even in the best of the universities 2 years expensive MBA programmes.

Over the years, as a Financial Planner, I have realised that financial planning is less about numbers and more about human emotions.

For e.g. If I tell a couple that you should save at least 20% of your disposable income and start investing that money into a regular savings plan which after 18 years would be worth X amount, it may not sound appealing to them. At the same time, if I say the same thing to a couple who recently got blessed with a child, they will start investing for their child's future, and there is a higher chance that they may not push that goal for a later date.

Some of you may not believe me, but few of my clients who don't have children yet have already started saving for their child's higher education because they understand that they would need money for this definite goal one fine day. On the other hand, I meet clients who come to me when their child is 15 years old to save for their child's higher education with only 3 years left until he / she goes for higher studies.

Financial goals are not just numbers; they are events that everyone in the family looks up to, but sadly it boils down to only one member of the family planning towards it, and others never become a part of that planning.

My advice is to try and make it a family activity because there is a feeling of commitment and empowerment when you plan jointly. Everyone has a say in it. Take the views of your children. Let them feel involved, as this is a life skill that no one teaches. It will bring much more enjoyment in the entire exercise. At the same time, you will be inculcating the habit of planning in your kids, which they will remember and follow when they grow up.

Involve & inform all the family members in your financial planning

I recently shared this article with all my clients, which is one of the repercussions of not involving your family members in your financial planning -

The latest shocking data reveals that nearly USD 11.30 Billion is sitting unclaimed in India right now and this figure has increased by 150% in just last 2 years.

Have you shared the details of all your investment & insurance plans with your loved ones?

The final step

Life Insurance and Investments are important for your future, but what's the point if your legacy is not passed on smoothly to your next generation?

The final step of a brilliant financial planning is " Legacy Planning "?

It is important that husband and wife must spend at least two hours, every quarter, going through their finances.

During those two hours, they both must go through all their financial documents and ensure that either their children or their parents are aware of all their investments and insurance.

Over a decade into this profession, I have never shared one copy of any investment/insurance policy document to my 300 + clients. I carry at least 3 sets of all the important documents with my personal email Id and contact number on top of it. When I meet any of my new clients after setting up their financial solution in place; I insist that they share the plan with family members who are added as beneficiaries.

Here is the link to one ' Data Collection Sheet ', which I have shared with most of my clients to simplify their lives.

Please feel free to download this and share the completed version with your loved ones. Ensure they are always updated about all the assets you have built during your lifetime for their future. As mentioned above, many individuals fail in the last stage of Financial Planning that is - Legacy Planning.

Therefore, in case you don't engage your family members in one of the most important discussions of your life and if you haven't shared your investment details with your loved ones till date, I would like you to think - Why am I building all these assets when I don't have a plan in place for its smooth transition to the next generation?

So, plan a financial date with your spouse once every quarter and make her feel that her inputs matter to you like I have been doing for over 5 years now because a family that plans together; stays together!

Bio

As an experienced and a qualified Financial Advisor, I am passionate about helping all my clients achieve their dreams through goal-based holistic financial planning.

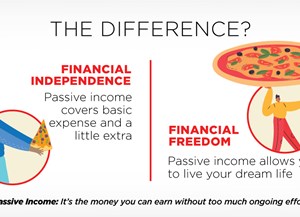

With 10+ years of experience in Strategic Financial Planning, Risk Assessment and Market Research I have the ability to contribute financial services domain knowledge to all my clients. Over the last decade, after meeting more than 1,500 professionals / business owners, what I have realized is that with added responsibilities and the kind of profile they are into, most of the people find it really difficult to take out time and plan for their own finances. I don’t promise to make you ‘Super Rich’ as my aim is to empower everyone with the knowledge of disciplined financial planning, which would help them become financially secure and independent.

Remember – “Ideas don’t change your life; you change your life with the power of great ideas by implementing on them”.

Email – Raunak.mehta@cfsgroup.com

Call - +971-56 719 8557

Website – www.raunakmehta.com